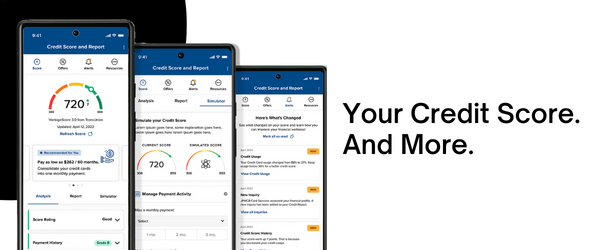

SavvyMoney helps you stay on top of your credit score, prevent fraud, and save money all from TruNorth’s online or mobile banking. Your credit score is updated daily and SavvyMoney will give you an understanding of the key factors that impact your score as well as tips on improving it. SavvyMoney also offers a simulator that shows impacts to your credit score and other resources such as articles and goals to help improve your score.

SavvyMoney FAQs

*THIS NOTICE IS REQUIRED BY LAW. You have the right to a free credit report from AnnualCreditReport.com or (877) 322-8228, the ONLY authorized source under Federal law.